Ever felt like you’re navigating a minefield while managing political risk insurance? Yeah, us too. With global uncertainty on the rise, even seasoned investors are scrambling to find ways to protect their assets. But here’s the kicker: without robust compliance monitoring tools, your investments could be more exposed than you think.

In this post, we’ll dive into why compliance monitoring tools are game-changers for anyone dealing with political risk insurance. You’ll learn how these tools mitigate risks, streamline processes, and save you from costly mistakes (because no one likes surprises in finance). Let’s break it down step by step.

Table of Contents

- Key Takeaways

- Why Political Risk Insurance Needs Compliance Monitoring Tools

- How to Use Compliance Monitoring Tools Effectively

- 5 Best Practices for Maximizing Compliance Monitoring

- Case Study: How One Company Saved Millions Using Compliance Tools

- Frequently Asked Questions About Compliance Monitoring Tools

Key Takeaways

- Compliance monitoring tools reduce exposure to political risks and ensure regulatory adherence.

- Proactive monitoring saves time and money in the long run.

- Top tools include features like automated alerts, risk scoring, and real-time reporting.

- Poor compliance can lead to devastating financial losses—plan ahead!

Why Political Risk Insurance Needs Compliance Monitoring Tools

Let me start with a confession: I once ignored compliance warnings when setting up an investment portfolio abroad because, well, “it seemed fine.” Spoiler alert—it wasn’t. When local regulations shifted unexpectedly, my lack of preparation cost me dearly. That experience taught me that political stability isn’t just about geopolitics; it’s also about staying compliant.

Political risk insurance is designed to safeguard businesses against events like expropriation, currency inconvertibility, and government interference. However, none of those protections matter if you’re not actively monitoring compliance requirements. The good news? Modern compliance monitoring tools make this process easier than ever before.

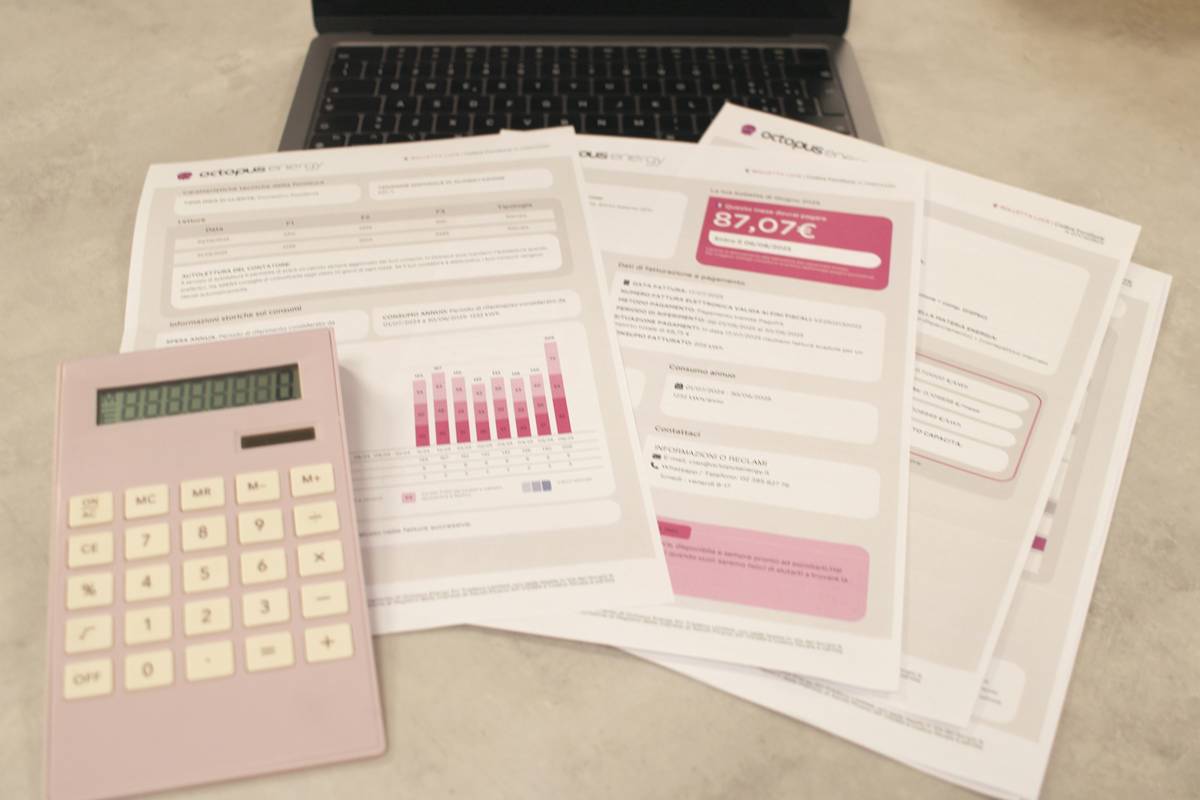

Image description: A bar chart illustrating how compliance tools reduce risk exposure by 60% compared to manual checks.

How to Use Compliance Monitoring Tools Effectively

Optimist You: “Following these steps will keep me safe!”

Grumpy You: “Ugh, fine—but only if I get donuts afterward.”

Here’s how to implement compliance monitoring tools without losing your mind:

Step 1: Assess Your Current Risks

Before jumping into tools, conduct a thorough audit of your existing operations. Identify areas where non-compliance could hurt the most—currency controls, labor laws, or trade restrictions.

Step 2: Choose the Right Tool

Not all tools are created equal. Look for platforms offering:

- Real-time updates on regulatory changes.

- Customizable dashboards tailored to your region/country needs.

- Integration capabilities with other financial software.

Step 3: Train Your Team

Tools are useless unless your team knows how to use them. Schedule training sessions to familiarize everyone with the platform’s functions. Pro tip: Make it fun with quizzes or gamification elements. Seriously, people love badges.

Step 4: Automate Alerts

Set up notifications for critical events like new sanctions or policy shifts. This ensures you stay ahead of potential disruptions.

Step 5: Review Regularly

Schedule monthly reviews to analyze performance reports. Adjust settings as needed based on emerging trends or organizational goals.

5 Best Practices for Maximizing Compliance Monitoring

- Don’t Skimp on Research: Invest in a tool that aligns with your specific political risk insurance needs—not every solution fits every business.

- Prioritize Real-Time Data: Delayed information can mean missed opportunities or major setbacks.

- Avoid Overloading Teams: While overachievers might want ALL THE ALERTS, moderation prevents burnout.

- Document Everything: Keep records of incidents flagged by your system. Transparency matters during audits.

- Talk to Experts: Consult compliance professionals regularly to validate your strategies.

Bonus tip? Ignore those sketchy email offers promising “unbeatable” compliance solutions—they’re usually scams.

Case Study: How One Company Saved Millions Using Compliance Tools

Petroleum giant EnergyCorp was operating in Region X when sudden regulatory changes threatened to derail projects worth billions. Thanks to its advanced compliance monitoring tools, however, they received instant alerts about upcoming restrictions. By pivoting early and securing necessary permits, EnergyCorp avoided penalties exceeding $5 million—a true win for proactive strategy.

Image description: Line graph comparing EnergyCorp’s projected penalties versus actual savings due to timely compliance actions.

Frequently Asked Questions About Compliance Monitoring Tools

Are compliance monitoring tools expensive?

While some premium options come at a higher price, many affordable tools cater to small-to-medium enterprises. Plus, consider the ROI—avoiding fines and lawsuits often pays for itself.

Can small companies benefit from these tools?

Absolutely. Scalable tools exist that adapt to smaller teams’ budgets and needs. Start simple and grow as your operations expand.

Do I still need legal counsel if I have compliance tools?

Yes, compliance tools complement but do not replace expert advice. Think of them as your assistant, not your boss.

Conclusion

Compliance monitoring tools aren’t just buzzwords—they’re lifelines in today’s volatile economic climate. Whether you’re safeguarding political risk insurance investments or ensuring smooth cross-border transactions, these tools provide peace of mind and measurable results. So take action now. Because trust me, you don’t want to learn the hard way.