Ever thought about what would happen if a sudden political crisis tanked your business investments abroad? It’s not just a plot twist from a thriller—it happens more often than you’d think. Political risk insurance exists to cushion these blows, but only when paired with smart Risk Mitigation Strategies. Let’s dive into how you can safeguard your financial future and avoid costly surprises.

This post will guide you through understanding political risk insurance, implementing actionable mitigation strategies, and avoiding common pitfalls. You’ll also get real-world examples to inspire your approach. Ready? Let’s break it down.

Table of Contents

- Key Takeaways

- What Is Political Risk Insurance?

- Step-by-Step Risk Mitigation Strategies

- Best Practices for Managing Risks

- Real-Life Success Stories

- Frequently Asked Questions

Key Takeaways

- Political risk insurance protects businesses against losses from geopolitical instability.

- Smart Risk Mitigation Strategies include diversifying markets, monitoring global events, and using predictive analytics.

- Neglecting proper due diligence could lead to catastrophic financial losses—don’t skip the boring stuff!

What Is Political Risk Insurance?

Think of political risk insurance as the ultimate backup plan for international ventures. It shields companies from unforeseen financial hits caused by government actions (like expropriation), civil unrest, or currency inconvertibility. Sounds solid, right?

However, here’s where I messed up big time once—I assumed buying the policy was enough. Spoiler alert: it isn’t. If my project had gone sideways without proactive risk management, even the best insurance wouldn’t have saved me.

Infographic illustrating different scenarios covered under political risk insurance policies.

The optimist in me thought, “Hey, just slap some coverage on this bad boy, and we’re golden!” But the grumpy side replied, “Yeah, okay, but you better read every clause.” Trust me, that advice is chef’s kiss.

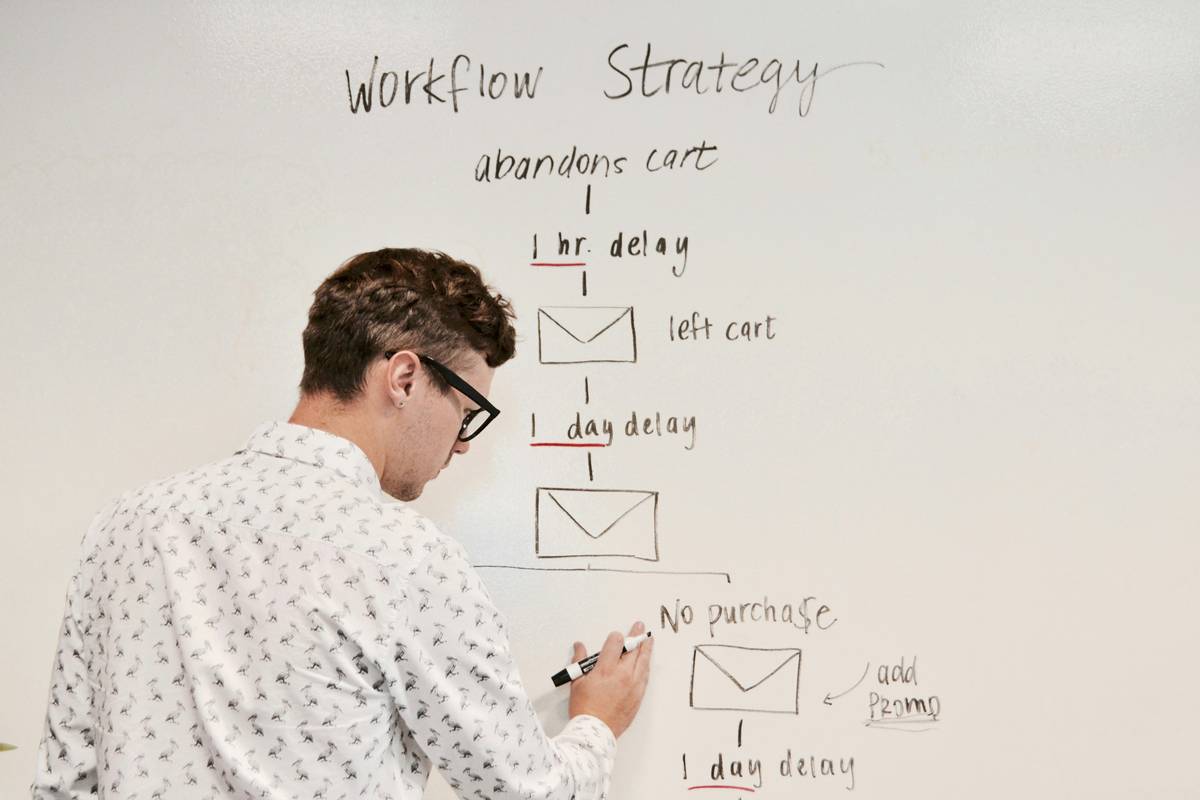

Step-by-Step Risk Mitigation Strategies

Lucky for you, I’ve compiled a foolproof list of steps to mitigate risks effectively.

1. Conduct Thorough Due Diligence

Start by researching the country you’re investing in. Look at historical data on political stability, corruption indices, and past conflicts. Sound tedious? Absolutely. Like running Chrome with 50 tabs open—it’ll whirrrr until your laptop screams.

2. Diversify Geographic Exposure

Don’t put all your eggs in one basket—or one region. Spreading operations across multiple countries reduces reliance on volatile areas.

3. Monitor Real-Time Events

Stay updated on geopolitical news using tools like Bloomberg or Reuters. Knowing early gives you time to pivot before disaster strikes.

4. Engage Local Experts

Consult lawyers, consultants, or advisors familiar with the local landscape. Their insights can save you from stepping on landmines.

5. Leverage Predictive Analytics

Tools like AI-powered forecasting platforms help predict potential upheavals based on patterns. Because sometimes, you need tech that feels smarter than you are.

Best Practices for Managing Risks

Now let’s talk practical tips:

- Regular Policy Reviews: Ensure your coverage evolves with your operations.

- Network Building: Foster relationships with local officials—they might warn you of brewing trouble.

- Exit Plans: Yes, always have an escape route mapped out. Even Indiana Jones had a backup whip.

Note: Here’s a terrible tip—ignoring your gut instinct. Don’t be that person who thinks, “Oh, this place seems chill,” and skips basic checks. Rookie move.

Real-Life Success Stories

Take Company X, which operates in Southeast Asia. They diversified their supply chain after learning about trade tensions between two neighboring nations. When tariffs spiked unexpectedly, they barely felt the pinch thanks to their Risk Mitigation Strategies.

Or consider Startup Y, whose CEO hired a local legal team to navigate regulatory changes during an election year. Their preparation paid off when new laws threatened foreign investors—they adapted instantly.

A chart showing improved performance metrics after applying effective risk mitigation tactics.

Frequently Asked Questions

Q: Do I really need political risk insurance?

Yes, if you’re doing business internationally, especially in regions prone to instability.

Q: Can small businesses afford these strategies?

Absolutely. Many steps, like monitoring events or consulting experts, don’t require massive budgets.

Q: How do I choose the right insurer?

Research providers specializing in political risk, check reviews, and compare terms meticulously.

Conclusion

Protecting yourself against political risks involves more than just purchasing insurance; it requires thoughtful Risk Mitigation Strategies. From conducting due diligence to leveraging technology, each step builds resilience. Avoid lazy shortcuts—even seasoned pros make mistakes.

Remember, staying informed and prepared keeps your financial future safer. Now go forth and conquer those uncertain waters!

Like a Tamagotchi, your risk management needs daily care. Feed it with knowledge, water it with action, and watch it thrive.