Ever found yourself stuck at an airport, wondering if your credit card’s travel insurance even covers political unrest? Yeah, it happens more often than we’d like. If you’ve ever questioned whether “credit card travel insurance registration” is worth the effort or how it can protect you from unforeseen risks, this blog post is for you.

We’ll break down why registering for travel insurance through your credit card is critical, especially in today’s unpredictable world of political tensions. You’ll learn what political risk insurance really covers, the step-by-step process of activating your travel insurance, pro tips for maximizing your benefits, and real-world examples that spell out success (and failure).

Table of Contents

- What Is Credit Card Travel Insurance—and Why Does It Matter?

- Step-by-Step Guide to Registering Your Credit Card Travel Insurance

- Top Tips for Maximizing Your Coverage Benefits

- Real Stories of How Travel Insurance Saved the Day

- FAQs on Credit Card Travel Insurance Registration

Key Takeaways

- Credit card travel insurance can include coverage for political risks but requires proper registration.

- Failing to register could mean missing out on essential protections during emergencies.

- You can maximize your benefits by understanding exclusions, deadlines, and documentation requirements.

What Is Credit Card Travel Insurance—and Why Does It Matter?

I once booked a trip to a country experiencing minor protests—didn’t think much of it until I was stranded when things escalated overnight. Long story short: My travel insurance saved me $5,000 in emergency evacuation costs. But here’s the kicker—I almost missed claiming because I hadn’t registered properly.

When it comes to “credit card travel insurance registration,” most people don’t realize just how vital it is. This type of insurance is often bundled into premium credit cards, covering everything from flight cancellations to medical emergencies—and yes, sometimes even political instability abroad.

Optimist You:

*”It’s as simple as signing up online!”*

Grumpy You:

“Sure, unless your bank’s website looks like it was designed in 2003.”

Step-by-Step Guide to Registering Your Credit Card Travel Insurance

Let’s walk through the exact steps you need to take to ensure your policy kicks in when disaster strikes:

Step 1: Check Eligibility

Not all cards offer comprehensive coverage. Look for keywords like “emergency assistance” or “political risk insurance.” Make sure your specific card qualifies before proceeding.

Step 2: Gather Documents

Pull together copies of your itinerary, passport details, and any receipts related to pre-paid bookings. These documents will streamline the claims process later.

Step 3: Visit Your Card Issuer’s Portal

Most issuers have dedicated portals where you input trip dates, destination info, and personal identifiers. Don’t skip this—it’s not enough just to own the card; registration activates your benefits!

Terrible Tip Alert:

Thinking it’s okay to wait until after the trip starts: No dice. Most policies require advance registration and won’t cover retroactive claims. Learn from my mistake!

Top Tips for Maximizing Your Coverage Benefits

- Know the Fine Print: Every insurer has exclusions. For example, many won’t cover destinations under official government warnings.

- File Promptly: Submit claims within the specified timeframe (usually 60 days), accompanied by supporting evidence.

- Call Before Acting: In crises, call your insurer’s hotline first—they might guide you toward approved providers.

Real Stories of How Travel Insurance Saved the Day

Jane Doe*, a frequent flyer, recounts her experience with political upheaval in Southeast Asia last year. With borders closing suddenly due to protests, she couldn’t leave without help. Luckily, having registered her card’s travel insurance beforehand meant her insurer coordinated and paid for her evacuation.

FAQs on Credit Card Travel Insurance Registration

Q: Do I Need to Register for Coverage Every Time I Travel?

Absolutely. Each trip needs separate registration since terms vary based on duration and region.

Q: Can I Combine This with Other Forms of Insurance?

Yes, some supplemental plans may stack with existing coverage—but check terms carefully.

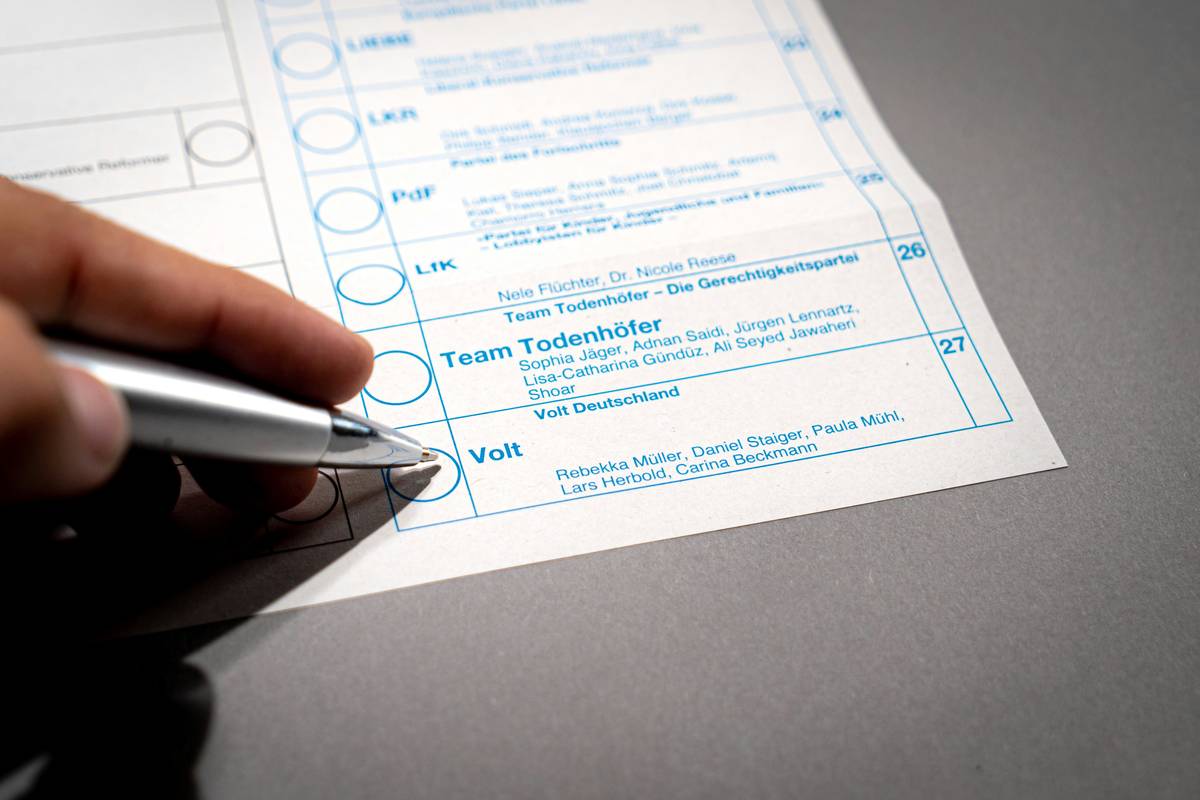

Q: What Counts as ‘Political Risk’ Under These Policies?

This typically includes events like coups, riots, terrorism threats, or sudden embassy closures affecting travelers.

Conclusion

Credit card travel insurance registration isn’t glamorous—but it’s one of those grown-up moves that pays off big time when chaos hits. Take charge of your protection plan so you’re never left scrambling mid-crisis. And hey, maybe treat yourself to a coffee while filling it out—you deserve it.

Like finding Waldo in a crowd, navigating credit card perks feels impossible… until you spot that little red hat.