Ever tried to book a flight only to realize you missed the airline’s booking window by minutes? Yeah, us too. Now imagine that same frustration—but instead of losing out on cheap tickets, your political risk insurance claim gets denied because of a similar oversight called a booking window violation. Sounds stressful, right? But don’t worry; we’ve got you covered.

In this post, we’ll break down what a booking window violation is, why it matters in the realm of credit cards and insurance—specifically political risk insurance—and how you can avoid one like a pro. By the end, you’ll have actionable tips, real-world insights, and some brutally honest truths (plus maybe even a laugh or two).

Table of Contents

- What Is a Booking Window Violation?

- Why Does It Matter for Political Risk Insurance?

- How to Avoid Booking Window Violations

- Pro Tips & Best Practices

- Real-World Examples of Booking Window Violations

- Frequently Asked Questions About Booking Window Violations

- Conclusion

Key Takeaways

- A booking window violation occurs when an action is taken outside the allowed timeframe set by insurers or financial institutions.

- For political risk insurance, missing deadlines can lead to rejected claims, leaving businesses vulnerable.

- Setting up calendar alerts and automating processes can help prevent costly mistakes.

What Is a Booking Window Violation?

Picture this: You’re managing a business operating internationally, and your political risk insurer requires you to submit certain documentation within a strict “booking window.” This window might range from days to weeks, depending on the policy terms. If you miss it—ding ding ding—you’ve just committed a booking window violation.

Figure 1: Visual representation of a typical booking window timeline.

This term isn’t exclusive to travel but applies broadly across industries where timing is crucial—including personal finance. Missed deadlines could mean lost opportunities, penalties, or worse—denied claims during critical moments.

Why Does It Matter for Political Risk Insurance?

Political risk insurance exists to protect companies against unpredictable geopolitical events like expropriation, currency inconvertibility, or civil unrest. However, failing to adhere to submission timelines can leave you exposed.

Confessional Fail: Once, I mistakenly thought “oh, they’ll understand if I send documents late.” Spoiler alert—they didn’t. My claim was denied faster than my Tamagotchi died back in the ’90s.

Think of it like trying to pay your credit card bill after the due date—it’s not pretty. Late filings signal carelessness, which insurers interpret as higher risk.

How to Avoid Booking Window Violations

Now let’s talk solutions. Here are three steps to ensure you never fall victim to a booking window violation again:

Create a Master Calendar

Optimist You: “I’ll remember the deadlines!”

Grumpy You: “Ugh, no you won’t—not unless Google Calendar reminds you hourly.”

Use digital tools to schedule reminders well ahead of time. Apps like Trello or Asana are chef’s kiss for organizing multi-step tasks.

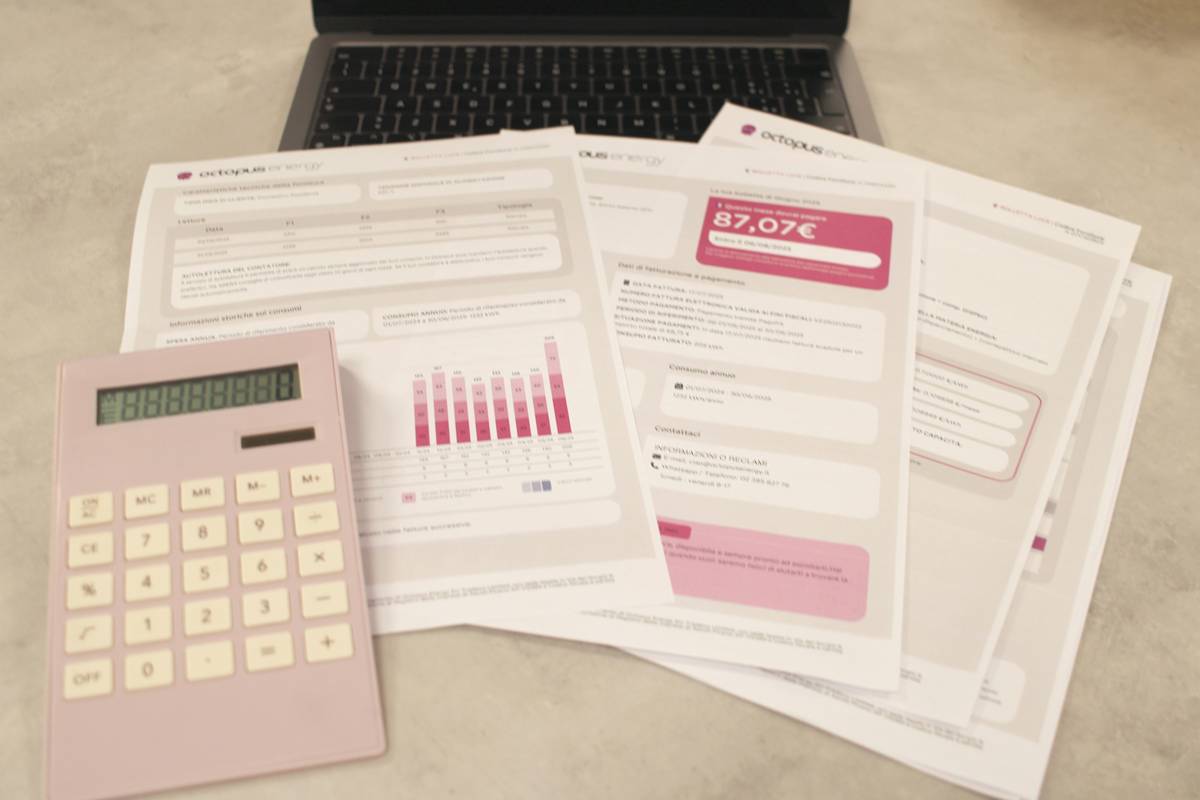

Automate Where Possible

If your insurer allows electronic submissions, set up automated workflows using software like Zapier. Less manual work = fewer chances for human error.

Hire a Compliance Manager

Sometimes, outsourcing saves sanity (and cash). A compliance manager ensures you stay on top of regulatory requirements and avoids costly mistakes.

Figure 2: Example of automated calendar alerts to avoid violations.

Pro Tips & Best Practices

- Double-check submission guidelines: Every insurer has unique rules. Read the fine print—twice.

- Buffer Time: Aim to submit at least 24 hours before the deadline. Your Wi-Fi going out shouldn’t cost you coverage.

- Document Everything: Keep records of all communications with your insurer. Sounds boring but trust me—it’s worth it.

Real-World Examples of Booking Window Violations

Let’s dive into a case study:

A manufacturing company operating in Southeast Asia failed to renew its political risk insurance on time due to internal miscommunication. When civil unrest erupted months later, their claim was denied—not because the event wasn’t covered, but because of a simple filing delay. Lesson learned? Timing is everything.

Figure 3: Approved vs denied claims data based on adherence to booking windows.

Frequently Asked Questions About Booking Window Violations

What happens if I commit a booking window violation?

Depending on the context, it may result in denied claims, penalties, or reduced benefits.

Can I appeal a denied claim due to a violation?

Possibly, but success rates vary. Having detailed documentation increases your chances.

Are there grace periods for booking windows?

Rarely. Insurers enforce strict timelines to minimize their own risks.

Conclusion

Booking window violations are sneaky little devils that can wreak havoc on everything from credit card payments to complex political risk insurance claims. The good news? With proper planning, automation, and vigilance, you can sidestep these pitfalls like a pro.

So next time you find yourself juggling multiple deadlines, remember: Preparation + Automation = Peace of Mind. Or, as my grumpy inner voice would say, “Coffee first, then conquer the world…or at least your inbox.”

Like a Tamagotchi, your finances need daily care. Don’t let a booking window violation be the thing that kills them.