Ever wondered why your political risk insurance claims keep getting denied? Spoiler alert: It’s probably because your team missed a crucial step in compliance training.

In this post, we’ll dive into the world of Compliance Training Programs—and how they’re not just boxes to tick but lifelines for businesses navigating the tricky waters of credit cards and insurance. By the end, you’ll understand why investing in these programs is non-negotiable, especially when managing risks like political instability. Let’s get into it!

Table of Contents

- Why Compliance Matters More Than You Think

- Step-by-Step Guide to Implementing Effective Compliance Training Programs

- 7 Tips for Crafting Winning Compliance Training Programs

- Real-Life Examples of Compliance Success Stories

- Frequently Asked Questions About Compliance Training Programs

Key Takeaways

- Non-compliance can lead to denied claims on political risk insurance.

- Effective compliance training minimizes legal headaches and boosts operational efficiency.

- The best programs are tailored to specific industries, such as finance or international trade.

- Investing in robust training pays off by preventing costly mistakes.

- A “set it and forget it” approach could be catastrophic—these programs require ongoing updates.

Why Compliance Matters More Than You Think

Optimist You: “We’ve got our bases covered!”

Grumpy You: “Uh, no—you forgot that one tiny regulation buried deep in page 47 of the policy.”

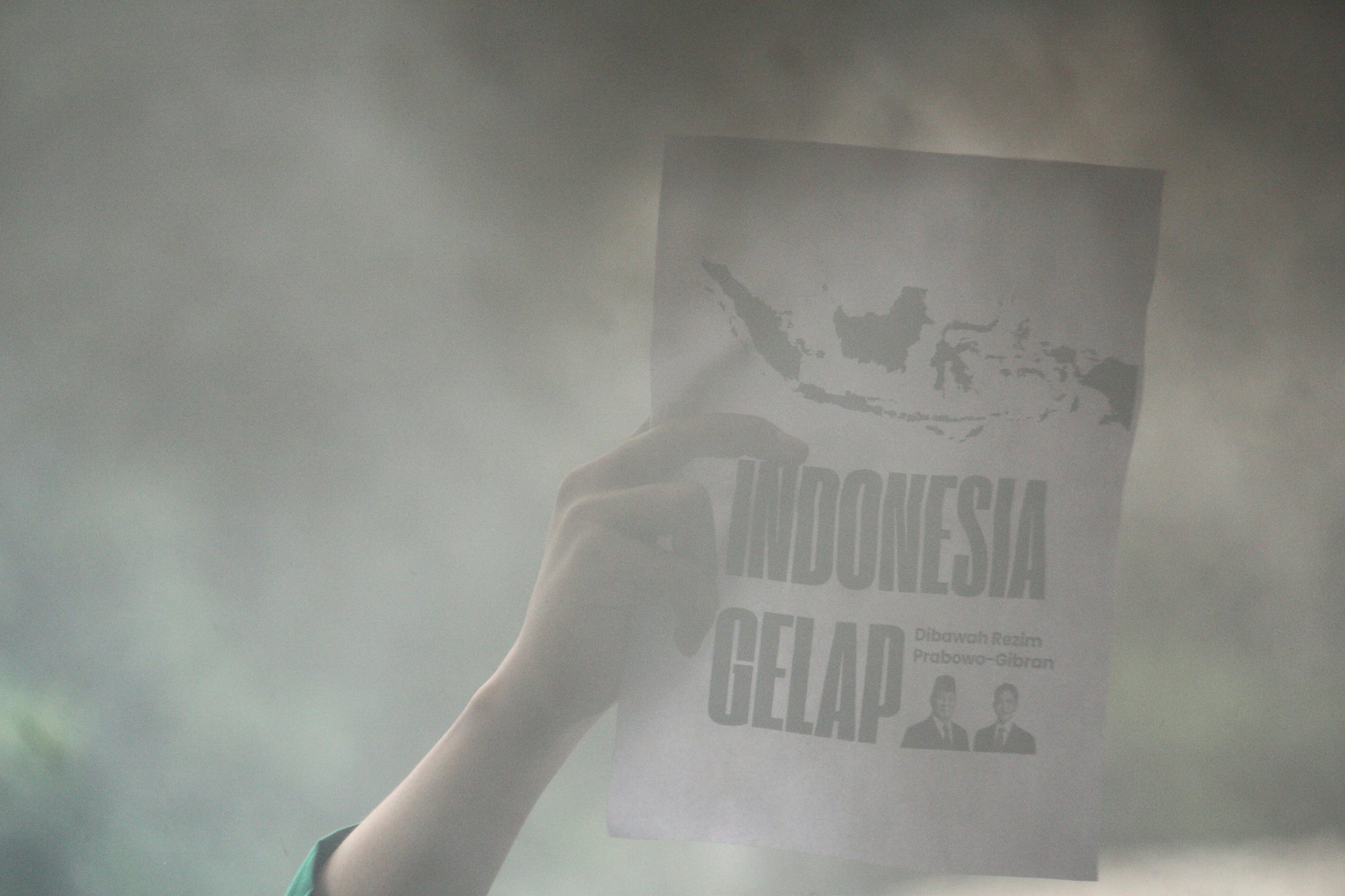

Let me paint a picture: Imagine your business heavily relies on international transactions, and suddenly a country you operate in undergoes regime change. Without adequate political risk insurance (PRI), you’re toast. But here’s the catch—even WITH PRI, if your team doesn’t comply with stipulated guidelines, guess what? Denied claim city awaits.

I once heard about an entrepreneur whose entire overseas venture collapsed due to unchecked compliance issues. Sounds dramatic, right? Except it’s real—and happens more often than anyone cares to admit. This isn’t just about following rules; it’s about safeguarding your assets, reputation, and peace of mind against geopolitical chaos.

Step-by-Step Guide to Implementing Effective Compliance Training Programs

Now let’s roll up our sleeves and walk through creating killer Compliance Training Programs. Because trust me, nothing screams “adulting done right” like proactive risk management.

Step 1: Identify Key Regulations Relevant to Your Industry

Start by listing out all relevant laws, regulations, and standards applicable to your field. For instance, companies dealing with PRI need to be mindful of international trade agreements, anti-corruption acts, and data privacy mandates.

Step 2: Assess Current Gaps in Knowledge

Do a knowledge audit. Where does your team stand today? Are there glaring gaps? If half your team has never even seen the latest ISO update, well… yikes.

Step 3: Partner with Legal Experts

You don’t have to go at it alone. Engage compliance consultants who specialize in political risk insurance and related areas. Their expertise will save you from future heartburn.

Step 4: Design Engaging Learning Modules

Create interactive content instead of dull PDF manuals. Gamify quizzes, use videos, and simulate real-world scenarios. It’s chef’s kiss for retention rates.

Step 5: Test and Iterate Regularly

Don’t launch once and ghost. Update modules quarterly, test employee understanding, and refine based on feedback.

7 Tips for Crafting Winning Compliance Training Programs

- Keep It Simple: Nobody likes jargon soup. Use plain language.

- Tailor Content: A one-size-fits-all program won’t cut it across departments.

- Leverage Technology: Tools like LMS platforms make tracking progress seamless.

- Motivate Employees: Reward those crushing their modules with shoutouts or incentives.

- Regularly Review Policies: Stay ahead of regulatory changes.

- Incorporate Real-World Scenarios: Case studies resonate better than hypotheticals.

- Avoid Overloading Info: Drip-feed learning over time rather than info-dumping.

Pro Tip: Avoid the trap of thinking “more is better.” Overloading employees with too many modules leads to information overload—and then, silence. Like crickets chirping loudly while everyone ignores the material.

Real-Life Examples of Compliance Success Stories

Take Company X, a mid-sized logistics provider operating globally. After implementing mandatory Compliance Training Programs, they reduced denied insurance claims by 40% within a year. How? They trained staff on documenting every transaction meticulously—a minor tweak, yet game-changing.

Or consider Startup Y, which integrated micro-learning modules into daily workflows. Employees loved the bite-sized lessons delivered via Slack bots. Result? A culture shift where compliance became second nature.

Frequently Asked Questions About Compliance Training Programs

Q: What exactly ARE compliance training programs?

A: These are structured educational initiatives designed to ensure employees adhere to regulatory guidelines, industry standards, and internal policies.

Q: Do small businesses REALLY need them?

A: Absolutely. Size doesn’t matter when regulators come knocking—or worse, insurers deny your claim.

Q: Can’t I just wing it?

A: Sure, but expect potential lawsuits, fines, or PR nightmares. Wingman mode = risky move.

Conclusion

So there you have it. From dodging denied PRI claims to fostering a bulletproof company culture, effective Compliance Training Programs aren’t optional—they’re essential. And yeah, setting them up may feel daunting, but think long-term gains over short-term pain.

Still skeptical? Picture this: Instead of drowning in red tape during audits, imagine breezy confidence knowing your team nailed every checkpoint. That sounds pretty zen, huh?

Oh, and before you go—here’s some nostalgia fuel for thought:

“Like a Tamagotchi, your SEO needs daily care.” Now THAT’S wisdom.