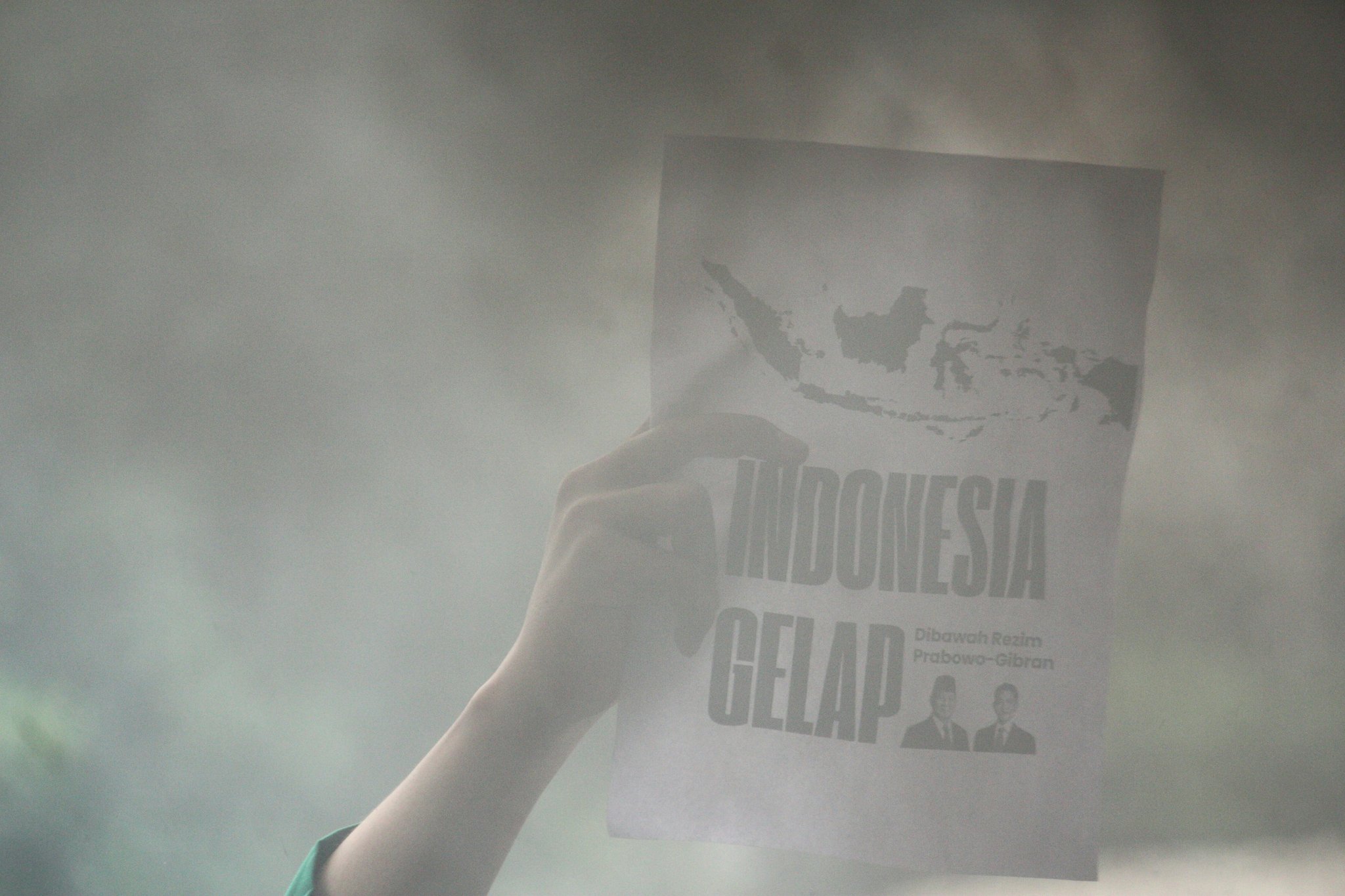

Ever wondered what happens when your business investment gets blindsided by a political coup halfway across the globe? Yeah, us too. If you’re dabbling in international ventures or high-stakes contracts, understanding coverage limits for political risk insurance could save your financial future.

In this guide, we’ll break down everything you need to know about coverage limits and how they affect your personal finance strategy. You’ll learn why these limits matter, how to pick the right policy, and tips to ensure you don’t get caught off guard.

Table of Contents

- Key Takeaways

- Why Coverage Limits Matter for Political Risk Insurance

- How to Choose the Right Policy with Adequate Coverage Limits

- Best Practices for Managing Risks Within Coverage Limits

- Real-Life Examples of Coverage Limits in Action

- FAQs About Coverage Limits and Political Risk Insurance

Key Takeaways

- Coverage limits define the maximum amount an insurer will pay out under a policy.

- For political risk insurance, higher coverage limits often mean more security—but also higher premiums.

- Understanding exclusions and fine print is crucial; not all risks are covered equally.

- Tailoring your coverage to specific geopolitical threats can save money and headaches.

Why Coverage Limits Matter for Political Risk Insurance

Let’s talk about that time I thought $500k in political risk insurance would cover EVERYTHING. Spoiler alert: It didn’t. My mistake? Not reading the fine print on coverage limits (and no, I wasn’t drunk—just overly optimistic).

The truth? Political risk insurance exists because governments fail, economies collapse, and currencies go poof overnight. But here’s the kicker: Most policies come with strict coverage limits. These caps determine how much of your loss the insurer will reimburse—and they vary wildly.

“Optimist You:* ‘Oh, my policy says ‘comprehensive.’ That must mean unlimited!’* Grumpy Me: *’Wrong. Read it again, champ.'”

From expropriation (government seizure) to currency inconvertibility issues, coverage limits dictate how much you walk away with if things go south. So before signing on the dotted line, make sure those numbers align with your worst-case scenario budget.

How to Choose the Right Policy with Adequate Coverage Limits

Selecting the perfect policy isn’t rocket science—but it does require some tactical thinking. Follow these steps:

- Assess Your Risks: Is your project located in a politically unstable region? Are currency controls likely? Answering these questions helps tailor your coverage.

- Match Your Investment Value: Ensure your coverage limit reflects the size of your investment. Too low, and you’re exposed; too high, and you’re wasting cash.

- Review Exclusions: Some insurers exclude certain events like civil unrest or sanctions. Understand exactly where gaps exist.

- Consult Experts: Work with brokers who specialize in political risk—they know which providers offer flexible coverage limits.

Pro Tip: Avoid choosing solely based on price. Think of cheap coverage as ramen noodles during a power outage—it might fill you up temporarily, but it won’t sustain you long-term.

Best Practices for Managing Risks Within Coverage Limits

Here’s the brutal honesty bit: Having insurance doesn’t absolve you from managing risks yourself. In fact, one terrible tip floating around suggests relying entirely on your policy. Don’t do this.

Instead, consider these best practices:

- Diversify Geographically: Spread investments across countries to reduce dependency.

- Hedge Currencies: Use financial instruments to protect against foreign exchange fluctuations.

- Build Local Partnerships: Collaborate with local entities familiar with regulatory environments.

- Stay Informed: Monitor global political trends regularly—it sounds dull until riots break out.

Rant Alert: Why does everyone ignore diversification advice?! It’s literally “cheat code” protection against catastrophic losses.

Real-Life Examples of Coverage Limits in Action

Take Company X, for instance. Operating in Country Y, their factory was nationalized due to sudden regime change. While their initial coverage limit seemed sufficient, hidden clauses reduced payouts significantly. Lesson learned: Always negotiate terms upfront!

On the flip side, Company Z avoided disaster by investing heavily in research prior to purchasing insurance. They ensured their coverage accounted for both overt risks (like asset seizures) and covert ones (currency instability). Moral of the story? Preparedness pays.

FAQs About Coverage Limits and Political Risk Insurance

What Are Typical Coverage Limits?

Limits typically range from 80% to 90% of insured value, depending on insurer appetite and client needs.

Can You Negotiate Coverage Limits?

Absolutely. Many insurers allow customization for additional fees.

Do All Events Qualify for Payouts?

Nope. Specific triggers like government intervention or embargoes may apply.

Conclusion

Navigating coverage limits in political risk insurance requires diligence, foresight, and sometimes a dash of luck. By following our actionable steps and avoiding common pitfalls, you’ll safeguard your assets while expanding globally.

And remember…

Storm clouds gather fast, But smart choices shelter well— Coverage saves today.