Ever thought your investment was safe, only to have a political uprising tank it overnight? Yeah, us too.

Political risk insurance might sound like something only multinational corporations care about, but let’s be real—it’s becoming more relevant for everyday investors. Today, we’re diving into the ins and outs of political risk FAQs, so you’ll know exactly what questions to ask and how to protect your assets. By the end of this post, you’ll understand why political risk insurance matters, who needs it, and how to get started.

Table of Contents

- What Is Political Risk Insurance?

- Key Takeaways

- Why Does Political Risk Matter?

- How to Buy Political Risk Insurance

- Tips for Managing Political Risks

- Real-World Examples of Political Risks

- Risk FAQs

- Conclusion

Key Takeaways

- Political risk insurance protects against financial losses caused by government actions or political instability.

- You don’t need to be a Fortune 500 company to benefit from political risk coverage.

- The process involves understanding the specific risks tied to your investments.

- Choosing the right provider can make or break your policy effectiveness.

What Is Political Risk Insurance?

Let’s talk basics. Political risk insurance shields businesses and investors from losses due to unstable governments, expropriation, civil unrest, currency inconvertibility, and even war. Sounds extreme? Maybe. But when it happens, you’re grateful for that backup parachute.

Example: Imagine owning property abroad. Suddenly, the local government decides all foreign-owned land now belongs to them. Without insurance, you’d lose everything. With political risk insurance? You file a claim and recoup some or all of your losses.

Why Does Political Risk Matter?

Optimist You:* “Why should I worry about this?”

Grumpy You:* “Because no one saw Brexit coming either!”*

Here’s my confession—I once advised an investor to go big on emerging markets without considering their stability scorecard (yeah, rookie move). A coup d’état later, they were scrambling for damage control. Lesson learned? Always consider political risk!

This isn’t just for corporate giants. Even small-time investors expanding internationally face these challenges. Think of political risk as the whirring laptop fan during tax season—a constant reminder that danger lurks if ignored.

How to Buy Political Risk Insurance

Purchasing political risk insurance isn’t as straightforward as picking credit cards or life insurance. Here’s a step-by-step guide:

Step 1: Assess Your Needs

- Evaluate where your investments lie geographically.

- Analyze potential threats in those regions.

Step 2: Research Providers

- Look at reputable insurers specializing in global politics.

- Compare premiums, exclusions, and claims processes.

Step 3: Tailor Coverage

- Select specific risks you want coverage for.

- Ensure terms align with your business goals.

Tips for Managing Political Risks

- Diversify Investments: Spread out globally instead of concentrating in one volatile area.

- Stay Updated: Follow geopolitical news regularly.

- Hire Experts: Consult professionals familiar with regional dynamics.

- Talk Less Online: Avoid public commentary that could provoke unwanted attention. (*Pro tip here: Silence truly is golden.*)

Terrible Tip Alert:* “Ignore international trends; focus locally.” Riiight, because ignoring global shifts worked well for Blockbuster…NOT.

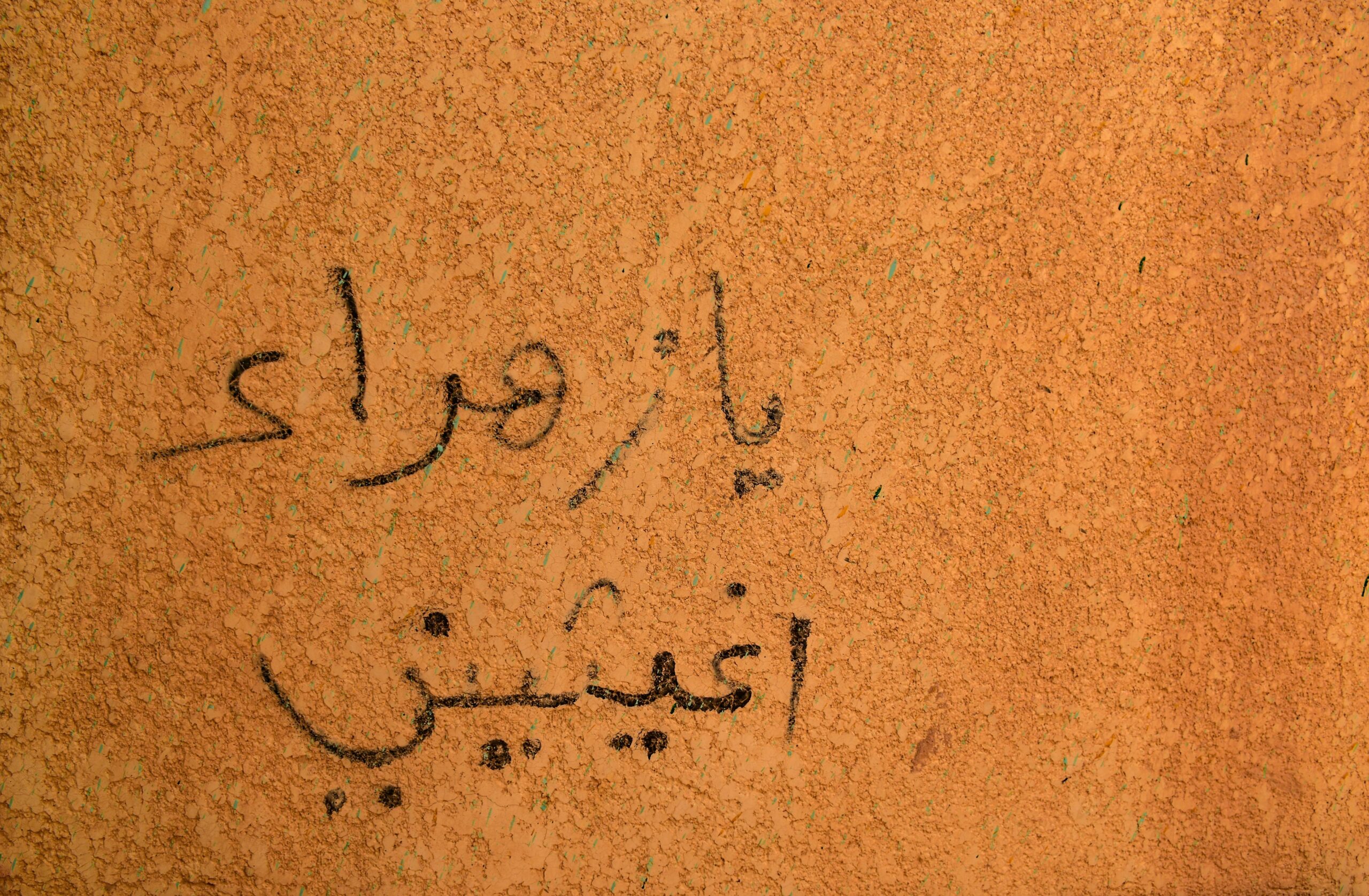

Real-World Examples of Political Risks

Take Venezuela, for instance. Years of hyperinflation rendered savings worthless overnight. Investors holding Venezuelan bolivars faced massive losses unless they’d safeguarded themselves.

Another example? Turkey. Sudden restrictions on non-resident purchases left many foreign buyers stranded mid-transaction. Having political risk insurance would’ve mitigated such blows significantly.

Risk FAQs

Is Political Risk Insurance Only for Big Businesses?

Nope! Smaller investors are increasingly seeking these protections too.

How Much Does It Cost?

Costs vary widely based on exposure levels and coverage specifics. Expect anywhere from 1% to 5% of insured value annually.

Can I Get Coverage for Any Country?

While most countries are eligible, extremely high-risk areas may require additional scrutiny.

Conclusion

There you have it—an easy-to-follow roadmap through the labyrinth of political risk management. Remember, knowledge empowers action. So whether you’re eyeing overseas real estate or dabbling in forex trading, keep these risk FAQs handy.

Like navigating a minefield, arming yourself with information keeps you safe. Now go forth and conquer—just maybe not after lunch since food coma hits hard.

“Protect what you cherish,

Against storms unforeseen.

Future-proof wealth today.”