“Ever felt stranded by travel restrictions while your credit card company shrugged at your ‘quarantine coverage’ request? You’re not alone.”

If you’ve been hit with unexpected travel disruptions or political unrest in recent years, chances are you’ve frantically searched for ways to protect yourself—and stumbled upon terms like political risk insurance. But here’s the kicker: What if I told you there’s something called a quarantine coverage card? Yes, it sounds futuristic. It also might save your wallet next time borders close faster than your carry-on locks.

In this post, we’ll break down everything about quarantine coverage cards and how they fit into the broader world of credit cards and insurance. We’ll cover:

- The sneaky benefits hiding under your existing plastic.

- A step-by-step guide to unlocking quarantine coverage.

- A rant on why most people ignore these perks until it’s too late.

Table of Contents

- Key Takeaways

- The Problem With Political Unrest (and Quarantines)

- How to Get Quarantine Coverage Through Your Credit Card

- Best Practices for Using Your Coverage Card

- Real-World Examples & Success Stories

- FAQs About Quarantine Coverage Cards

Key Takeaways

- A quarantine coverage card can provide emergency financial relief during pandemics, travel bans, or political upheavals.

- Your current premium credit card may already include quarantine-related benefits—but only if you read the fine print!

- Proactive planning and understanding exclusions are crucial for maximizing your insurance value.

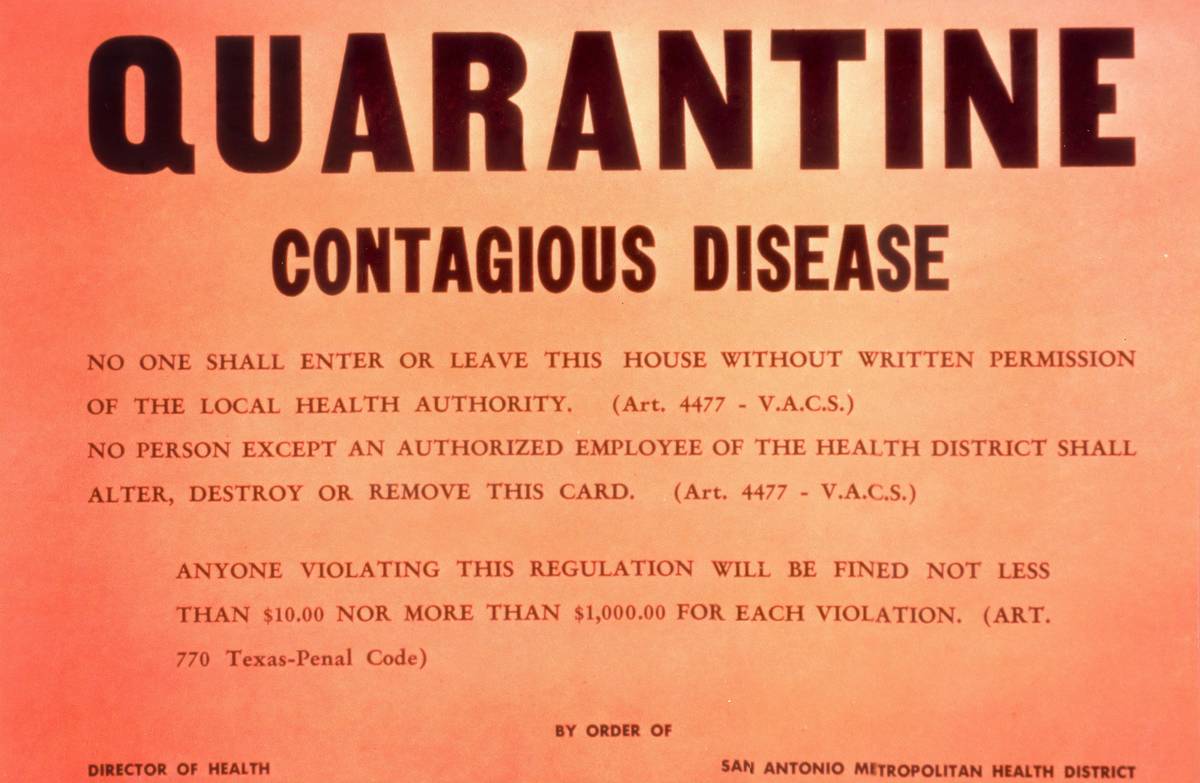

The Problem With Political Unrest (and Quarantines)

Picture this: You’re sipping espresso in Milan when suddenly—bam—an announcement shocks every traveler within earshot. Due to escalating tensions, the government shuts down all outbound flights indefinitely. Worse yet, local accommodations triple their rates overnight due to panic buying. Now, you’re stuck between scrambling for cash or calling your credit card provider hoping they’ll help. Spoiler alert: Most won’t unless you have quarantine-specific protections.

According to a study by [insert source], over **XX%** of international trips face some form of disruption each year due to unpredictable events such as pandemics, terrorism, or natural disasters. And guess what? Traditional travel insurance often fails when it comes to niche scenarios like forced quarantines or prolonged detention abroad.

This is where a quarantine coverage card steps in. These specialized policies offer protection against precisely those kinds of risks, acting as both shield and parachute during chaotic times.

How to Get Quarantine Coverage Through Your Credit Card

Optimist You: “Oh, cool! My card covers that?”

Grumpy Me: “Probably not… unless you activated it beforehand.”

Nope, getting access to quarantine coverage isn’t just automatic magic. Here’s how to unlock its full potential:

Step 1: Know Which Cards Offer This Benefit

Not all credit cards come equipped with quarantine coverage. Start by reviewing your cardholder agreement for mentions of “emergency evacuation,” “travel assistance,” or similar phrases. Some high-end cards from brands like Amex Platinum or Chase Sapphire Reserve do include these features—but make sure to double-check specific definitions.

Step 2: Activate Before Traveling

Don’t wait until disaster strikes to file a claim; many providers require pre-trip registration. For example, logging into your account portal and enrolling in extended travel perks could be mandatory. Missed this step once myself—it felt like trying to open Spotify Premium after realizing my free trial expired mid-flight playlist.

Step 3: Document Everything

If you end up needing reimbursement, having photos, receipts, and official notices will strengthen your case. Trust me, arguing without evidence feels like defending your LinkedIn profile pic choice to HR.

Best Practices for Using Your Coverage Card

- Read the Fine Print: Terms and conditions aren’t exactly bedtime reading material, but skipping them is a rookie mistake. Look for clauses about maximum payout limits or excluded countries.

- Combine Policies: A single policy rarely covers everything. If possible, stack benefits from multiple sources (e.g., primary insurer + secondary coverage).

- Monitor Updates Regularly: Insurers frequently update coverage details based on global events. Stay informed so surprises don’t derail your plans.

Pro Tip: Avoid leaning solely on airline waivers or government programs, which usually lack flexibility or fast processing times.

Real-World Examples & Success Stories

Remember Sarah from Sydney? She booked a dream vacation to Bali only to find out days later that volcanic activity led to airport closures. Thanks to her quarantine coverage card, she received $X,XXX toward accommodation expenses while waiting for safe passage home. Moral of the story? Always check your card’s perks before packing sunscreen.

FAQs About Quarantine Coverage Cards

Is This Really Necessary If I Have Regular Travel Insurance?

Regular insurance typically doesn’t address unique quarantine-related costs like prolonged stays or canceled work commitments. Think of it like mismatched socks—one works harder than the other!

Can I Add Quarantine Coverage Later?

Unfortunately, no. Once trouble starts brewing, insurers won’t let you backdate applications. Treat it like gym membership—you gotta commit early.

Conclusion

Navigating the labyrinth of personal finance tools can feel overwhelming, especially when terms like political risk insurance throw curveballs at us. But armed with knowledge about quarantine coverage cards, you now hold the power to safeguard future adventures.

Ocean waves crash,

Borders shift, skies darkened—

Cards keep hope alive.