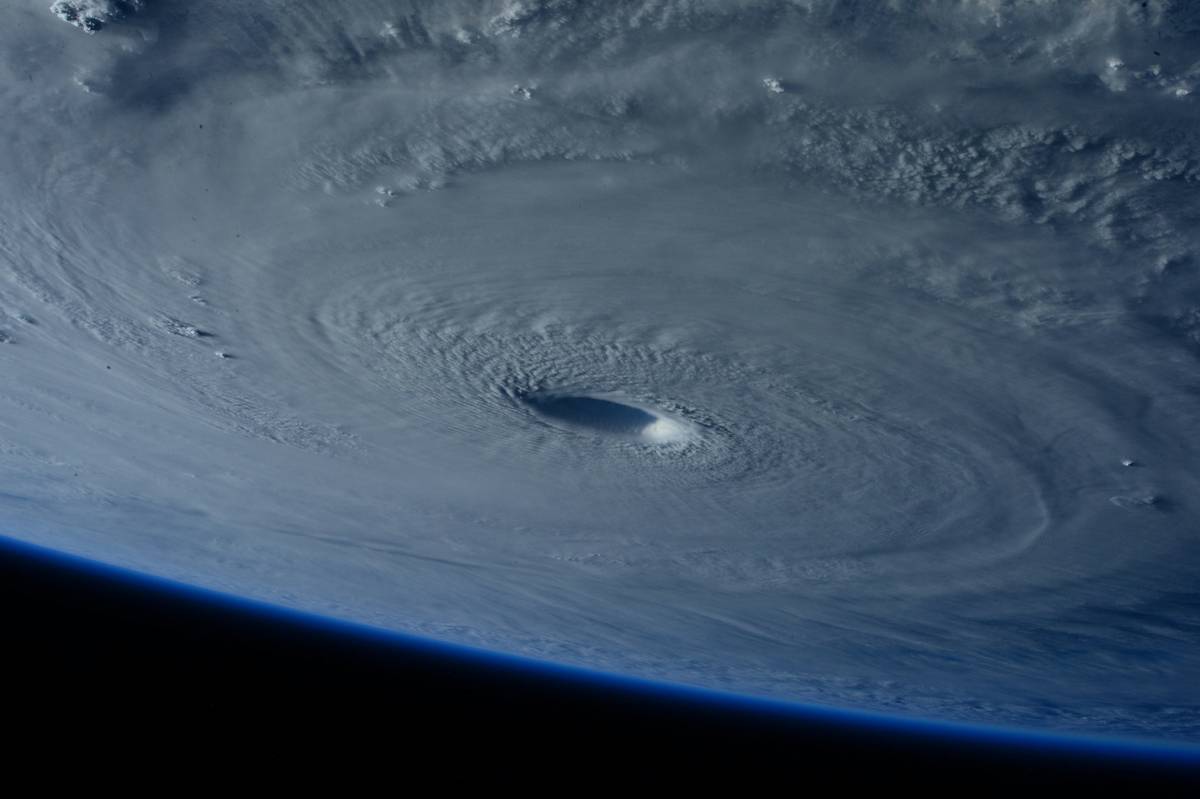

Hook: Imagine this: a hurricane wipes out critical infrastructure in a country where your business operates overseas. Suddenly, you’re facing massive losses—and no insurance safety net. Sounds like a nightmare, right?

If you’re navigating international business or investments, one overlooked solution can protect your assets from chaos caused by natural disasters: political risk insurance with natural disaster coverage.

In this guide, we’ll break down why natural disaster coverage is essential for businesses exposed to global risks. We’ll also explore how to secure it, common mistakes people make, and actionable tips to stay ahead of the game.

Table of Contents

- Why Political Risk Insurance Matters

- Step-by-Step Guide to Getting Natural Disaster Coverage

- Top Tips for Maximizing Your Policy

- Real-World Examples and Success Stories

- Frequently Asked Questions

Key Takeaways

- Natural disaster coverage under political risk insurance safeguards against unforeseen environmental crises abroad.

- Securing comprehensive coverage involves understanding your exposure, working closely with brokers, and regularly reviewing policies.

- Beware of “one-size-fits-all” solutions—they often leave gaps in protection.

- Regular policy audits ensure you’re not overpaying or underinsured.

Why Political Risk Insurance Matters

Let’s admit it: venturing into foreign markets feels like walking through a minefield sometimes. Between fluctuating currencies, shifting regulations, and unpredictable geopolitical events, there’s always something lurking around the corner. But here’s the kicker—most companies forget about Mother Nature until she strikes back hard.

I learned this lesson the hard way once. Our company had a warehouse in Southeast Asia, where typhoons are practically seasonal. One year, a Category 5 storm hit without warning. Without adequate natural disaster coverage, our losses spiraled out of control. That wake-up call forced us to rethink everything—including integrating natural disaster coverage into our broader political risk strategy.

So, what exactly does natural disaster coverage cover? In short, it helps mitigate financial losses stemming from earthquakes, floods, hurricanes, wildfires, and other catastrophic events that may disrupt operations in politically volatile regions.

Optimist You: “Insurance will save me!”

Grumpy You: “Only if you’ve read the fine print…”

Step-by-Step Guide to Getting Natural Disaster Coverage

Step 1: Assess Your Exposure

The first task is identifying countries where you operate and their respective risk profiles. Tools like the World Bank’s Disaster Risk Management portal provide detailed insights into hazard-prone areas.

Step 2: Work With Experienced Brokers

Partnering with a broker specializing in political risk insurance ensures tailored advice. They’ll help negotiate terms that align with your specific needs rather than settling for generic packages.

Step 3: Customize Your Policy

Ask yourself:

- What assets need protection (physical infrastructure, supply chains)?

- How long do recovery periods typically last for similar industries?

- Do local laws affect claim payouts?

Step 4: Conduct Regular Audits

Review your policy annually to account for changes in operations, new risks, or updated regulatory frameworks. It’s tedious but necessary—like updating your phone OS just so Angry Birds doesn’t crash.

Top Tips for Maximizing Your Policy

- Diversify Your Coverage: Don’t put all your eggs in one basket; layer multiple insurers for better protection.

- Negotiate Better Terms: Haggle like you’re buying a used car at a flea market. Every clause matters!

- Document Everything: Keep meticulous records of asset values, operational timelines, and communications related to claims.

- Rethink Deductibles: Lower deductibles mean higher premiums but quicker access to funds during emergencies.

And now, drumroll please… A terrible tip to avoid:

“Ignore climate reports because they’re overly pessimistic.” Ugh, don’t be THAT person. Climate change isn’t going away—it’s accelerating. Ignoring science might save you bucks today but cost millions tomorrow.

Real-World Examples and Success Stories

Remember Japan’s 2011 earthquake and tsunami? Companies with robust natural disaster coverage bounced back faster, thanks to swift compensation claims processing. Meanwhile, those relying solely on standard property insurance faced crippling delays.

A similar story played out post-Hurricane Maria in Puerto Rico. Businesses insured under comprehensive political risk plans recovered weeks—if not months—ahead of competitors.

Frequently Asked Questions

Q: Is natural disaster coverage worth the extra cost?

Absolutely. The premium pales in comparison to potential liabilities arising from uninsured damages.

Q: Can I bundle natural disaster coverage with other types of insurance?

Yes, many providers offer integrated packages combining political risk, liability, and property insurance.

Q: Are pandemics covered under political risk insurance?

Typically no—but some bespoke policies include epidemic-related clauses. Always double-check!

Conclusion

Navigating the intersection of political instability and natural disasters isn’t easy, but having the right insurance keeps you afloat when storms—literal or figurative—hit. By assessing risks, customizing coverage, and staying vigilant, you’ll build resilience capable of weathering anything nature throws your way.

Random Haiku Time:

Storms rage across lands, Policies stand firm as rocks— Peace of mind reigns strong.